Happy New Year! Ring-out the old, ring-in the new.

Ring out investment year 2022 and bid it good riddance!

As one large Wall Street firm summarized the year’s ‘no place to hide’ investment environment:

“2022 was the worst year on record for long-term U.S. Treasury (bonds). The heralded 60%/40% stock/bond portfolio fell 24%, the worst return for this mix since (the) 1930s.”1

We never want to sound cavalier about investment setbacks, particularly nasty ones like that of 2022. But we believe the foundation for a resumption of rewarding longer-term returns is being formed.

More on this momentarily, but let’s first review the forces behind last year’s market mayhem. The driving forces were largely macro (‘big-picture’) factors including:

- The ‘lords of easy money’ 2 no longer easy: The primary influence on the markets in 2022 was Jerome Powell and the Federal Reserve’s (Fed) campaign of ‘tightening’ monetary policy to fight inflation.

- Recession fears: With many of their counterparts around the world joining the Fed’s race to hike interest rates—the cumulative tightening has been considerable. As a result, recessions here and abroad are now widely expected.

- Geopolitical troubles: We suspect everyone knows about the geopolitical tensions around the globe, so we won’t list them here. (We do share some thoughts in the Appendix.)

- The wide U.S. political divide: The only area that appears to have strong agreement within our country is that it is on the ‘wrong track’.

These macro points are not a surprise to anyone. The 24/7 headlines—wherever one gets their ‘news’—will continue to keep them front and center…particularly if they’re gloomy. Gloom and doom are good for media ratings after all.

Investment trends are also not changed—alas—by a simple turn of the calendar. The Fed continues to signal that more interest rate hikes are ahead. Geopolitical angst will almost certainly persist, and domestic political discourse will remain shrill.

Ring in the new…accumulating change

The conventional study of economics breaks the field into macro and micro disciplines. Macro assesses the economy through a ‘top-down’ attempt to ‘see the forest through the trees’ approach.

Micro, by contrast, focuses on the economics of the firm (i.e. a business). Micro, in essence, focuses on the ‘trees’.

In the real world, the U.S. economy is being shaped by both macro and micro factors. Macro is often the lens through which most economic activity is viewed, however.

As a long-term observer of the economic scene noted recently:

“Macroeconomics, despite the thousands of highly intelligent people over centuries who have tried to figure it out, remains, to an uncomfortable degree, a black box. The ways that millions of people bounce off one another — buying and selling, lending and borrowing, intersecting with governments and central banks and businesses and everything else around us — amount to a system so complex that no human fully comprehends it.” — Neil Irwin, Senior Economics Correspondent, The New York Times

Irwin’s comment reflects the problem inherent with assessing things from the macro view. What’s going on with the individual trees often become lost in the blur of focusing on the forest.

And the macro headlines of today are overshadowing significant changes that are occurring within the economy, for the ‘trees’ are on the move.

The changes occurring are helping shape, we believe, what will be a more positive big-picture macro-economic scene. They are also setting the foundation for better times for investors.

As we’ve noted on prior occasions, an underestimated aspect of our modern economy is its resilience. Resilience stems from the increasing dynamic nature of commerce.

This dynamism is driven by human ingenuity. It powers innovation, change, adaptation, improvement, and lifts the standard of living for nearly all. It is a key part of the secret sauce behind our economy—apparently so secret that many policymakers here and abroad fail to understand or appreciate its importance.

Financial writer Morgan Housel is spot-on in noting that the driving force behind the problem-solving dynamic when he states:

“Optimism is the belief that odds of a good outcome are in your favor over time, even as there will be setbacks along the way. The simple idea that most people wake up each morning trying to make things a little better and more productive…is the foundation of optimism.” —Morgan Housel

Henry Kaiser, whose shipbuilding efforts helped turn U.S. fleets from being the hunted (by German U-boats) during World War II into becoming the hunters, put it this way:

“Problems are only opportunities wearing work clothes.” —Henry Kaiser

Other voices from business history reinforce Kaiser’s view on this subject.

“Of all social institutions, business is the only one created for the express purpose of making and managing change.” —Peter Drucker (economist and business consultant)3

“The definition of business is problem solving. A simple fact of business life: success lies not in the elimination of problems but in the art of creative, profitable problem solving. The best companies are those that distinguish themselves by solving problems most effectively. Indeed, business is problem solving.”4 —Consumer product entrepreneur and philanthropist, Irving Harris

It’s not by mere coincidence that we own businesses within our portfolios that operate with Kaiser’s work clothes, problem-solving mentality.

Most of the companies in which we have investments provide ‘mission critical’ solution tools that help other businesses operate more efficiently. These include the provision of goods and services that enable other businesses and entities to better manage their operations (including supply chains), cost structure, research and development processes, deliver better products and services, operate more adaptable organizations, cope with tight labor markets, and ‘do more with less’.

We believe the businesses we own qualify as among the ‘best companies’ within the Irving Harris observation: “The best companies are those that distinguish themselves by solving problems most effectively.”

The world will never run out of problems, so innovative solutions will remain in demand. Opportunities will be plentiful for the ‘best companies’. Businesses with Kaiser’s work clothes mentality and mission have the potential to be very rewarding compounding ‘machines’ for investors.

Examples of change and problem solving

The wait for the COVID mRNA vaccines seemed like an eternity at the time, yet the speed of their development and availability for distribution was, in fact, incredible.

Germany, after allowing itself to become beholden to Putin and reliant on Russia’s natural gas to meet its energy needs, has commissioned and allowed businesses to build the country’s first liquified natural gas (LNG) import terminal in less than a year. The facility is expected to be completed within the next few months.

(Isn’t it amazing how fast solutions to vexing problems can become reality when government’s help cut through the thicket of their bureaucratic state?)

We also must note that whatever opinion one holds about fracking, it has allowed the U.S. to become one of the largest producers of oil and natural gas. While many U.S. presidents promised (and failed) to make us ‘energy independent’, it was the frackers that pulled it off. U.S. energy exports are instrumental in allowing Europe to cope with Putin’s weaponization of energy.

Another important example relates to supply chains. The COVID economic shutdowns created havoc on economies.

Supply chains suffered significant stresses as:

- The economic shutdowns restricted the supply of goods.

- Trillions of dollars pumped into the U.S. economy by politicians stoked the demand for goods.

Chart 1 reflects the pressures on supply chains that resulted from the intersection of the ‘too much money chasing too few goods’ situation that was created.

Chart 1: Federal Reserve Bank of NY: Global Supply Chain Pressure Index

(Unprecedented supply stress occurred. But significant change is also underway…)

Chart source: Federal Reserve Bank of New York, Global Supply Chain Pressure Index

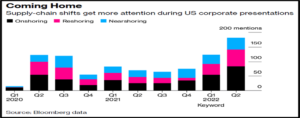

Chart 2 below reflects how businesses have been hyper-focused on supply chains problems.

Chart 2: New and Improved supply chains underway.

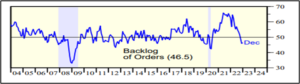

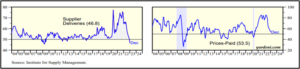

And, more importantly, businesses are not just talking about the problems; they are implementing solutions. As they have done so, supply bottleneck stress has diminished, and the improvement is also being reflected in decreasing order backlogs, speedier deliveries of goods/services and a significant easing of input price pressures (Chart 3 below).

Chart 3: U.S. Purchasing Manager Surveys—manufacturing and non-manufacturing.

Recent reports also suggest the supply chain problems associated with semiconductors that has restrained vehicle production has also been resolved. New and used vehicles have added to the COVID inflationary pressures. Used car prices have already recorded one of the largest declines in recent history. With new vehicle production constraints being overcome, expect new car price inflation to materially abate as well.

Overall inflationary pressures are easing as we’ll now review.

Inflation problem is in the process of unwinding

Just as the ‘too few goods’ situation is changing for the better, the ‘too much money’ condition has significantly changed for the better as well.

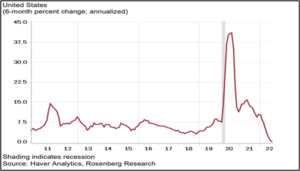

Chart 4 shows the money supply growth situation. As the repeated rounds of government COVID stimulus checks were cashed, the money supply was powered higher.

Chart 4: Money supply (M2 measure) surged from pandemic stimulus, now its rate of growth has sharply slowed.

But notice the change underway…money supply growth is running at a pace below pre-COVID trends. The fuel for sustained inflation from ‘too much money’, has been diminished.

Economist Scott Grannis provides a summary of the situation that is well worth considering:5

“The current episode of Fed tightening that we are living through is fundamentally different from all the others. Why? Because the excess money creation that fueled the surge in inflation over the past year was a one-off event that was tied directly to the trillions of dollars of fiscal stimulus that politicians pumped into the economy in the wake of the COVID lockdowns.”

The unwinding of inflationary pressures are being reflected in the popular inflation measures. In the Wall Street Journal, former Fed vice-chair Alan Blinder recently noted (we’ve added bolding to emphasize some points):

“Over the past five months, inflation has slowed to a crawl. Whether measured by the consumer-price index, or CPI, which most people watch, or the price index for personal consumption expenditures, or PCE, which the Federal Reserve prefers, the annualized inflation rate has been around 2.5% over these five months.

Yes, you read that right. Yet, hardly anyone has noticed this stunning development because of the near-universal concentration on price changes measured over 12-month periods, which are still 7.1% for CPI inflation and 5.5% for PCE inflation.

Normally, focusing on 12-month inflation rates is the right thing to do, for two main reasons. First, it guards against hyperventilation over “blips” in the inflation data, whether up or down. Second, it obviates the need for seasonal adjustment, since, for example, you are comparing prices in November 2022 with those in November 2021.

But when the inflation rate changes abruptly, 12-month averages can leave you watching recent history rather than current events. Today is one of those times.

Altogether, the inflation future does indeed look brighter than the inflation past.”6

What about the looming recession?

In the U.S., at least, it’s the most widely anticipated recession…ever! Businesses have been preparing for more difficult times for many months.

Stock prices are already anticipating a recession. Investor sentiment towards the markets and economy remains near extreme level of gloom about the future…a condition that historically has occurred before significant upside reversals in stock prices.

How can this happen if a recession indeed sets in? With pervasive fear, uncertainty and doubt, reality has a low expectations bar to clear. Given this backdrop, stock price movements will be less about whether things are ‘good’ or ‘bad’, but about whether things are likely to be ‘better’ or ‘worse’ relative to expectations.

‘Better than expected’ surprises will likely come from the under-appreciated resilience of our economy that we discussed earlier. Resiliency is already on display.

The financial surprise of 2022 was how fast and how much the Fed tightened monetary policy in their campaign to fight inflationary pressures. Multiple rounds of interest rate hikes of three quarters of a percent became the norm as the Fed lifted rates at the fastest rate since the 1970s. At the start of 2022, such increases were all but inconceivable without something ‘breaking’ in the financial plumbing underlying commerce.

Earlier we referenced a popular 2022 book, The Lords of Easy Money; How the Fed Broke the American Economy. The book’s thesis is that years of profligate borrowing has occurred due to the Fed’s easy money policies. A so-called debt trap has made the economy very brittle and vulnerable to severe contraction, according to the author.

Yet the feared broad-based strains from Fed tightening are not evident to this point. Yes, the stock and bond markets took it on the chin last year as fear, uncertainty, and doubt ran rampant. Yes, economic growth has waned (as it was destined to do) as the stimulus induced COVID sugar high ran its course. Yes, Britain pensions were rocked by rising rates and caused some heartburn for a few weeks last autumn. Yes, what appears to be a Bernie Madoff-like Ponzi scheme was exposed in crypto currencies.

Granted, Fed policy works with unknown lags, so constant evaluation of developments is necessary. Things could change for the worse. But serious stresses across the economy are not evident in key indicators that are sensitive to measuring mounting distress.

Bond investment outlook has significantly improved

Before proceeding into our final topic, we would be remiss not to mention one other important change that’s occurred—the rise in bond yields.

The way ‘bond math’ works, rising interest rates and bond yields cause bond prices to decline. With the rapid increase in bond yields last year, bond prices suffered one of the largest declines in U.S. history as noted earlier.

However, bond yields have now risen to levels not experienced in nearly 15 years. Bond’s risk/reward profile is altered by the increase in bond yields. The risk/return profile of the shorter-term, higher-quality bonds we favor within portfolios—for example—is much more attractive than it has been in years.

Instead of being a contributing source of angst within portfolios as it was last year, our bond investments should again become both a rewarding and stabilizing influence within portfolios.

The space in between

The Fed has its flaws to be sure. It makes mistakes and will likely continue to make more. They appear to be guided by some academic economic notions (Phillips Curve, strong economic growth causes inflation) that are poor models of the present dynamic economy.

But we believe recent experiences suggest that the Fed—unlike most other parts of government—tries to learn from their really big mistakes and tries not to repeat them.

“Some say the world will end in fire, some say ice.”

Robert Frost

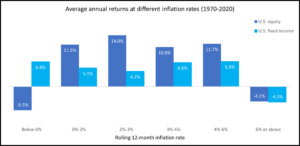

Consider Chart 5 below. The chart segments stock and bond returns by different inflation episodes since the start of the 1970s.

Chart 5: Investor quicksand lies in periods of ‘fire’ and ‘ice’.

The period depicted in the chart is bounded by periods we will call ‘fire’ and ‘ice’.

Ice represents the left most period in the chart—those (few) periods when inflation was below zero. Such ‘deflationary’ periods have been rare since the Fed’s founding in 1913. The granddaddy of sinister deflation was the 1930-32 period when the Fed allowed the financial system ‘pipes’ underlying commerce to freeze solid. The result was the catastrophic collapse within the banking system, the economy, stocks, and ushered in the Great Depression.

Chart 5 doesn’t stretch back to the 1930s, but it does cover two very recent episodes of ice in the financial system’s pipes. The two episodes include the subprime mortgage mess of 2008 and March of 2020 when the COVID shutdowns began.

Determined not to repeat the mistakes of their 1930s counterparts, the Fed of 2008 and 2020 took extraordinary policy measures to prevent a Great Depression repeat. Let’s hope things never get that perilous again. The modern-day Fed has demonstrated both the ability and willingness to prevent a 1930-32 repeat.

The other big mistake the Fed has made is enabling the great inflation of the late 1960s-early 1980s. This is the fire period on the right-hand side of Chart 5. When inflation has averaged more than 6% a year, both bonds and stocks have struggled.

Jerome Powell and today’s Fed are trying to prevent the mistakes of their 1970s counterparts. Their aggressive tightening actions are intended to tame the inflation fire lest it become imbedded throughout the economy as was the case in the 1970s.

As we documented earlier, we believe the COVID shutdowns and policy responses represent an epic shock to the economy with few historic parallels. Inflationary pressures are already dissipating and likely will continue to do so.

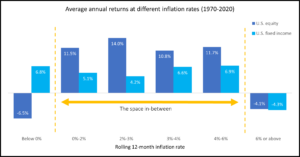

Still, the Fed is demonstrating its ability and willingness to prevent fire. If neither fire nor ice will be tolerated, investors may be facing the space between these extremes…historically rewarding periods by the way! (Chart 6 below).

Chart 6: The space between fire and ice has been good for investors.

Hang in there, it will be worth it!

Appendix

2022 was not a good year for the autocrats (Putin, China’s Xi and Iran’s ‘inviolable’ mullah leaders) of the world.

Putin—and the world—learned that Russia’s military looks better in parade than it does on the battlefront. Instead of displaying strength, severe weaknesses have been exposed.

China’s Xi is wrestling with massive domestic issues. These include a large real estate bubble, COVID, and a loss of economic momentum that will likely prove enduring. Replacing creative innovators/entrepreneurs with party-loyal bureaucrats is not conducive to economic growth.

Even as Xi touts the supposed success of his ‘scientific socialism’ the reality is as aptly described by China scholar Perry Link: “the Communist Party credits itself with ‘lifting millions from poverty,’ but it is more accurate to say that the millions have lifted the Party.” (In other words, the power of ‘micro’ was responsible for escaping poverty.)

Meanwhile Iran may well have a domestic revolution on its hands.

How any of this turns out, no one knows. It seems to us that the pundits were just as surprised about Russia’s weaknesses as Putin. Hopefully, Putin’s struggles give others pause in their designs for world conquest.

Despite the unclear geopolitical backdrop, Buffett’s comments still make sense:

“What I did was buy some good companies over time—and then waited.”

Warren Buffett

Sources & Notes

1 U.S. Performance Monitor, Bank of America/Merrill Lynch, January 2023

2 One of the most popular financial books published last year was: The Lords of Easy Money: How the Federal Reserve Broke the American Economy, by Christopher Leonard, Simon and Schuster, 2021. We’ll offer our perspective on its major premise in latter sections.

3 Towards the Next Economics, Peter Drucker, Harvard Business Review, 2010

4 Setting the Table, Danny Meyers, HarperCollins, 2006

5 Calafiabeachpundit.com

6 What if Inflation Suddenly Dropped and No One Noticed?, Alan Blinder, Wall Street Journal, January 5, 2023